Effective April 2, 2020 (or April 1, 2020 according to the United States Department of Labor), the Families First Coronavirus Response Act (the FFCRA) provides, among other things, paid leave to many employees affected by the current Coronavirus pandemic. This paid leave is provided by two provisions of the FFCRA: the Emergency Paid Sick Leave Act (EPSLA) and the Emergency Family and Medical Leave Expansion Act (EFMLEA).

The FFCRA is a complicated statute. The United States Department of Labor temporary rule governing just the paid leave provisions is 128 pages long. Moreover, over the coming days, weeks, months, and even years, more information, clarifications, and legal decisions are sure to come. But this is where things stand right now.

The FFCRA provides paid leave to an employee whose employer employs less than 500 people (or is a certain public entity) and who:

- is subject to a Federal, State, or local quarantine or isolation order;

- has been advised by a health care provider to self-quarantine;

- is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- is caring for an individual subject to an order described in (1) or self-quarantine as described in (2);

- is experiencing any other substantially-similar condition (further clarification of this is due soon); or

- is caring for a child whose school or place of care is closed (or child care provider is unavailable).

The duration and amount of an employee’s paid leave depends upon which of these six situations apply.

If you are unable to work due to reasons 1-5 (generally covering your health or the health of someone you care for), you may be entitled to 2 weeks of paid leave. If you are unable to work due to reason 6 (school or child care closure), you may be entitled to up to 12 weeks of paid leave. The leave applies for both full time and part time employees, although if you are part time, you’ll only receive pay for the average number of hours you generally work.

Regarding your rate of pay, if you take your 2 week leave for reason 1, 2, or 3, your employer must pay you your full rate of pay (or minimum wage-whichever is higher) up to $511 per day and $5,110 total. If you take your two week leave for reason 4 or 5, your employer must pay you 2/3 your regular rate (or 2/3 the minimum wage-whichever is higher) up to $200 per day and $2,000 total. Finally, if you take your 12 week leave for reason 6, your employer must pay you 2/3 your regular rate (or 2/3 the minimum wage-whichever is higher) up to $200 per day and $12,000 total.

The statutes have hardship exceptions for employers with less than 50 employees and those with less than 25 employees, and the extended 12-week leave is inapplicable to many federal employees. Moreover, in order to qualify for the extended 12-week leave, you must have worked for your employer for at least 30 days. Your leave is generally job-protected, meaning that in most situations, your employer must reinstate you after your leave. Moreover, your employer cannot discharge, discipline, discriminate, or retaliate against you for having taken paid leave or for having filed a complaint or instituted a proceeding related to the paid leave statutes.

If you are having an issue related to exercising your rights under the Families First Coronavirus Response Act, please contact Enright Law to obtain a free consultation to discuss your options. If your leave rights are being denied or you have been the victim of retaliation for having exercised those rights, you may have, in certain circumstances, the right to file a civil complaint. Enright Law represents victims of retaliation in Rhode Island and can help you enforce your employee rights.

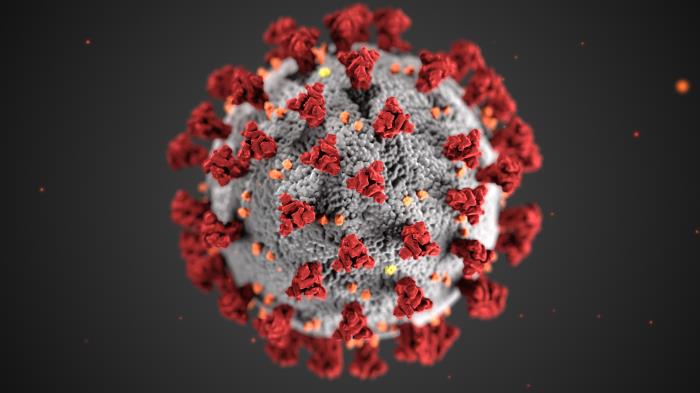

(picture courtesy of the CDC)